Latest Trends in Executive Compensation Oilfield Services, Drilling, and Related Sectors

Introduction

The latest trends in executive compensation emerge in Pay Governance’s Q4 2025 Executive Compensation Quick Pulse, completed by Compensation Committee members and CHROs representing 27 organizations across oilfield services, drilling, and related sectors. The overall message is one of measured continuity rather than disruption, as executive compensation programs are being refined, not restructured, while the sector continues to navigate persistent volatility.

Looking ahead, base salaries are expected to rise modestly, annual bonus payouts are trending below target, and long-term incentive (LTI) award values are expected to hold steady. These findings reflect a cautious yet stable outlook as companies balance talent retention priorities with ongoing market uncertainty.

Base Salary: Modest Increases Likely

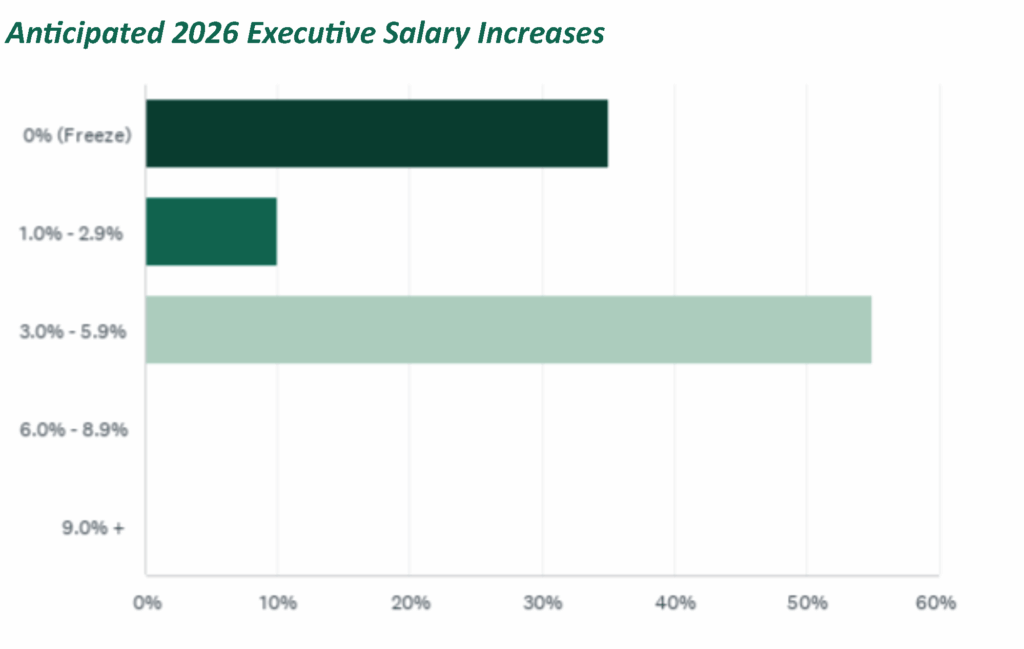

Organizations are signaling continued caution as they approach 2026 executive compensation planning. Most companies expect only moderate growth in base salaries, with more than half (55%) projecting C-suite increases in the 3.0% to 5.9% range and another 10% anticipating smaller adjustments of up to 2.9%. At the same time, 35% of organizations plan to freeze executive salaries, reflecting persistent uncertainty amid shifting market and operational conditions.

Overall, 65% of respondents expect 2026 salary adjustments to remain consistent with 2025 levels, while only 15% anticipate higher increases year over year. 20% of companies indicated that salary reductions are not off the table, highlighting the cautious approach many are taking as they navigate next year’s compensation cycle.

Industry fundamentals, particularly drilling rig utilization and the broader operational outlook, continue to play a central role in shaping compensation strategies. These factors are key indicators of financial health and investment confidence, influencing how organizations balance pay competitiveness with fiscal discipline.

Merit remains the primary mechanism for base salary adjustments. 40% of companies plan to apply increases across all executives, while 15% will target only specific roles. Nearly all organizations (95%) report no one-time retention related adjustments to base pay in 2026.

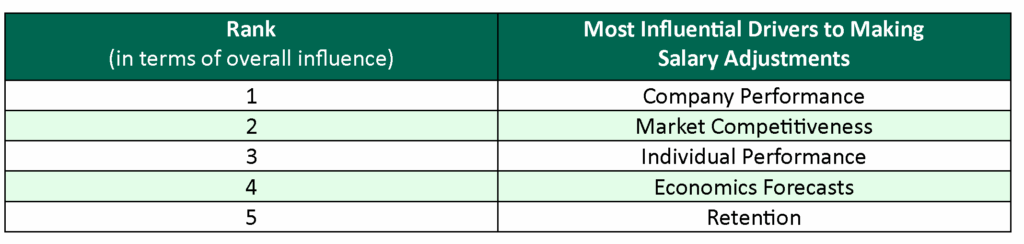

When ranking the most influential drivers of salary decisions, companies identified overall company performance and market competitiveness as the leading factors, followed by individual performance, retention considerations, and economic forecasts. Collectively, these findings point to a measured and data-driven approach to executive compensation that seeks to balance reward, retention, and financial prudence heading into 2026.

2025 Bonus Payouts: Below Target Payouts Will Be Common

Looking at bonuses earned in 2025 and payable in early 2026, 55% of respondents expect payouts to be at or near target (between 90% and 109% of target). 30% project above target payouts ranging from 110% to 149%, and just 10% anticipate 150% or above. Supply chain disruptions and tariff pressures have impacted accrued funding, yet the effect has been contained rather than catastrophic.

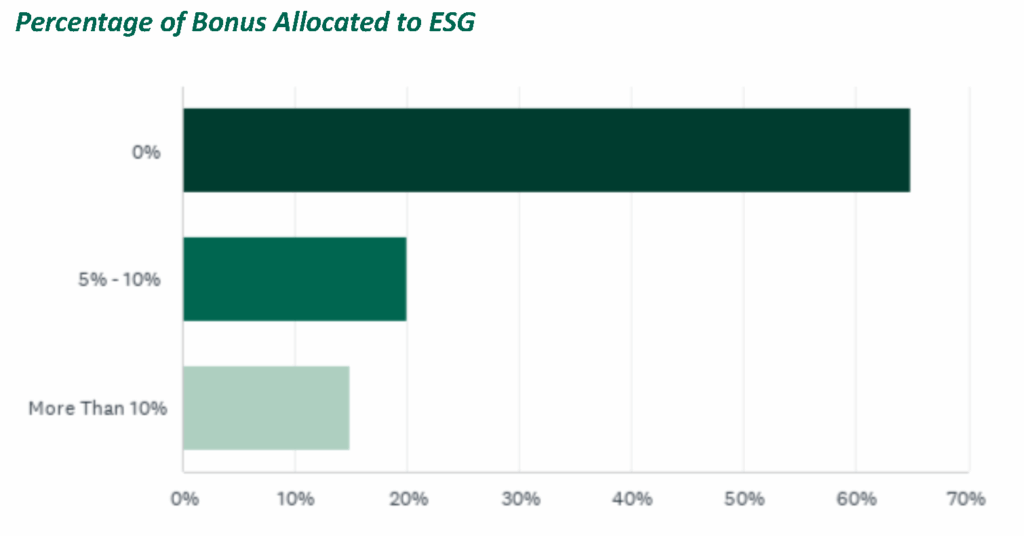

ESG integration continues its gradual ascent: 35% now allocate 5% or more of the bonus to environmental, social, and governance outcomes with an additional 20% at 5%–10% and 15% above 10%. The remaining 65% maintain zero weighting.

2026 Bonus Design: Incremental Change

85% of respondents expect no change to the width of their performance ranges despite uncertainty and variability across sectors, while 15% plan to widen ranges to account for ongoing volatility. Companies have historically widened performance ranges during periods of uncertainty to increase the likelihood of achieving a payout, even if below target, when results fall short of expectations. This approach is typically balanced by setting a higher threshold for maximum payouts.

Half of participants anticipate making minor adjustments or changes to performance measures used in the executive bonus program, whereas 40% remain undecided and plan to revisit potential changes in early 2026. 50% of companies indicated that tariffs on equipment and materials are expected to affect 2026 target setting either moderately or significantly.

Long-Term Incentives: Grant Values Expected to be on Par with Last Year

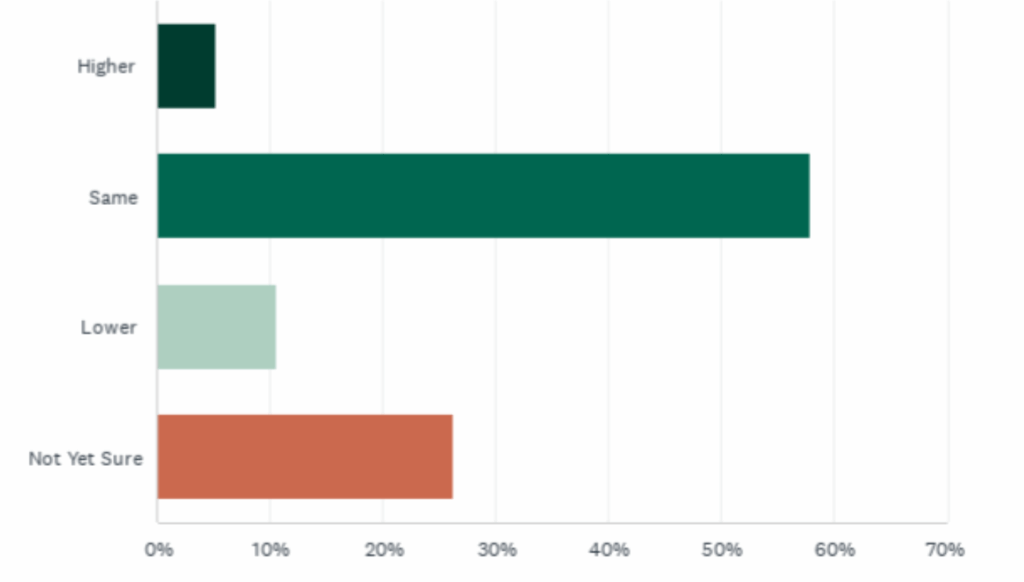

Long-term incentive (LTI) grant values are expected to remain largely stable. 58% of respondents plan to keep 2026 award values consistent with 2025 levels, while 5% anticipate increases and 11% expect reductions. The remaining 25% are undecided and plan to balance market competitiveness, overall performance, and share availability before finalizing decisions.

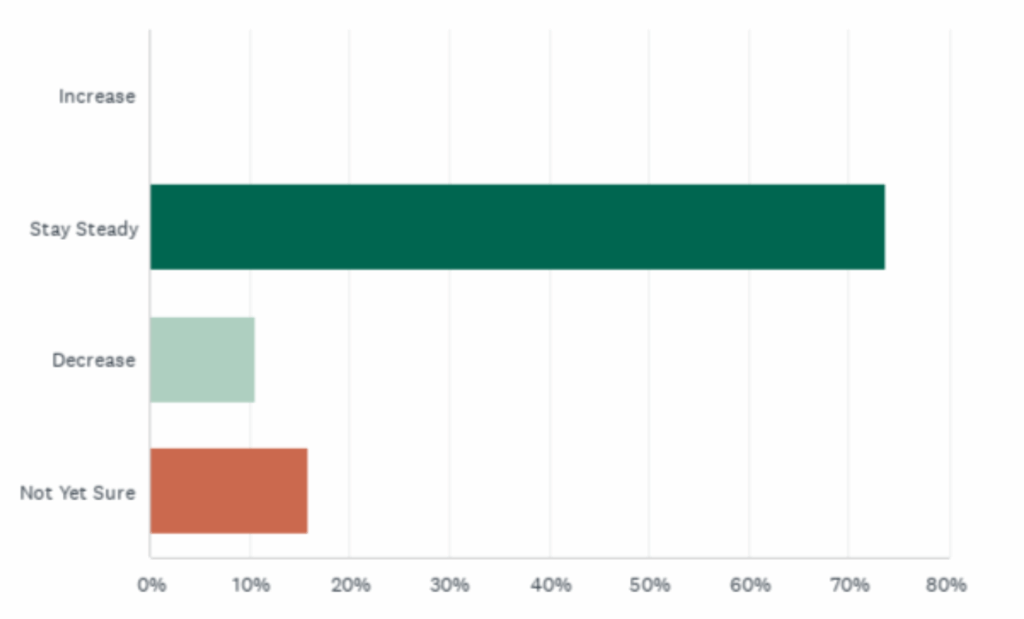

Company-wide LTI participation is also expected to hold steady for 74% of organizations. 10% anticipate reducing the number of participants in their LTI plans, while another 15% are still evaluating potential changes.

Overall, LTI plan design appears stable. 79% of companies anticipate making no changes to metrics or weightings, while 21% expect at least modest adjustments to performance measures. Relative performance measures have been increasingly favored for over a decade; however, a small emerging trend shows 15% of companies planning to place greater emphasis on absolute measures. AI and digital transformation are becoming part of the discussion, with 28% of organizations evaluating progress either qualitatively or through formal KPIs.

Share pool health does not appear to be a constraint. 94% of respondents report no or only moderate concerns regarding availability or burn rate, and 88% are comfortable with current run rates. Stock options remain a minority practice, although nearly 15% of companies indicated they may explore increasing allocations. 65% are satisfied with their current LTI mix, which is typically PSU-heavy, comprising at least 50 percent of the overall plan.

Despite recent conversations around the potential use of long-vesting RSUs to replace performance-based awards, long-vesting RSUs with five- to ten-year terms remain off the table for 88% of organizations.

2023 Performance LTI Payouts

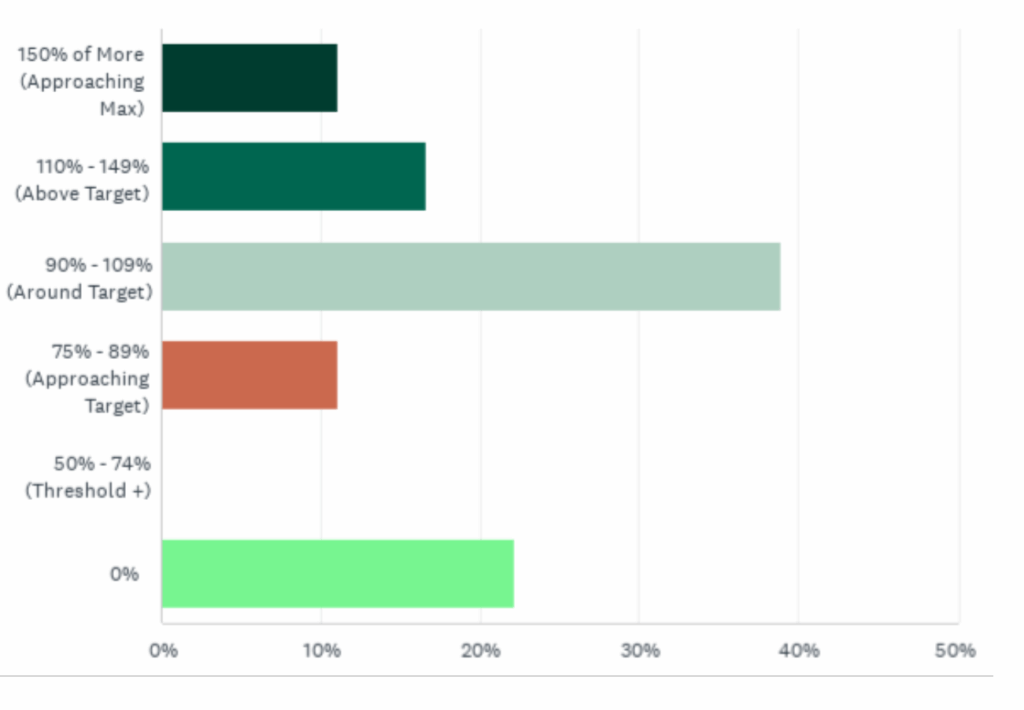

2023 performance LTI awards are scheduled to pay out at the end of 2025 and are showing mixed results across the industry. Nearly one in four companies (22%) forecast a $0 payout for the cycle, while 39% expect a near target payout and 28% anticipate payouts above target. An additional 11% indicate that current projections are approaching target, representing 75%-89% of the payout.

A key reason for this variability is the reliance on relative total shareholder return metrics in long‑term incentive plans. Differences in peer group composition, exposure to commodity price fluctuations, geographic contract mix, capital intensity, and operational efficiency can all contribute to varying outcomes, even among companies operating in the same sector.

Governance and Emerging Priorities

DEI goals are largely absent from incentive structures with 89% reporting no integration, having either never included or recently removed. Similarly, sustainability is not tracked in performance LTI awards at 78% of companies. The remaining 22% indicated it is tracked wholistically but not as a discrete measure in performance LTI awards.