S&P 500 CEO Compensation Trends

Key Takeaways

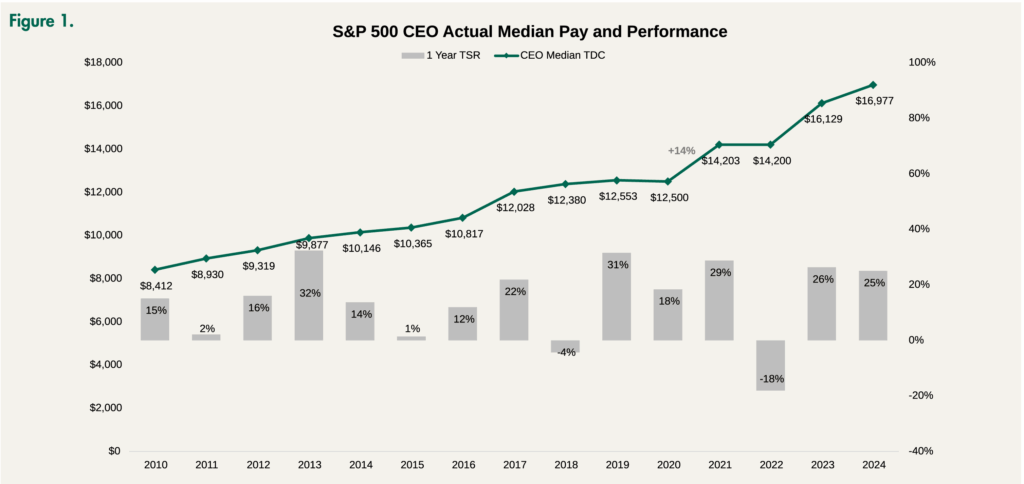

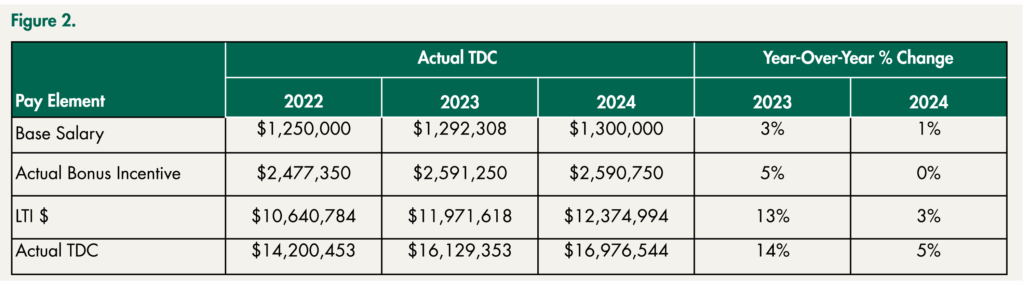

- CEO pay increases moderated in 2024. Median CEO actual total direct compensation (TDC)* reached $17M in 2024, reflecting a moderated 5% increase following a strong 14% increase in 2023.

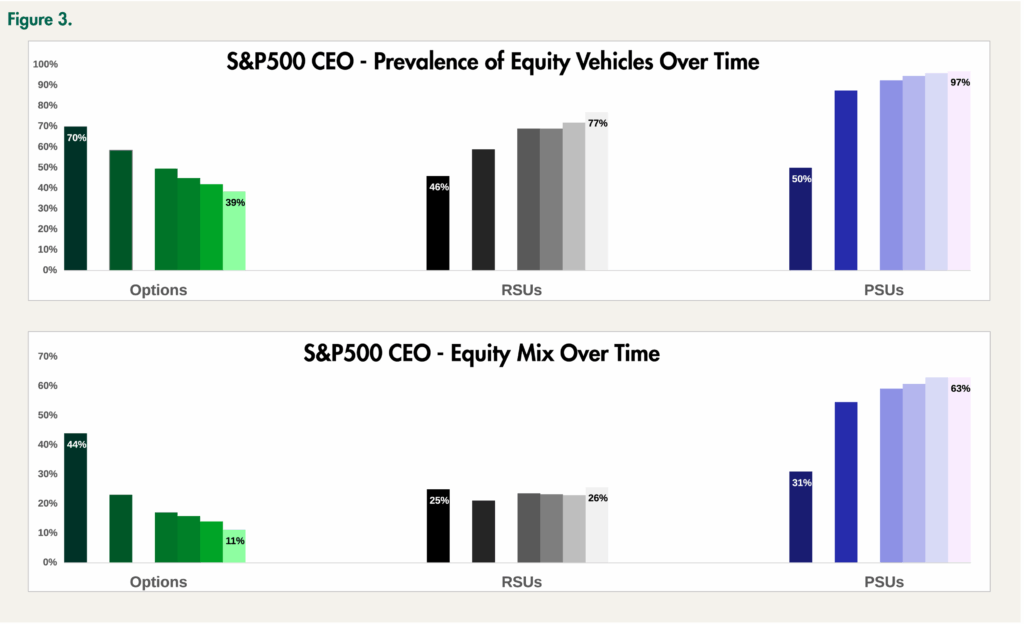

- Long-term incentive continues to dominate. Long-term incentives (LTIs) remain the primary driver of CEO compensation, with continued emphasis on performance-based equity, reinforcing alignment with shareholders.

- Shareholder returns remain strong. This was the third consecutive year of robust total shareholder return (TSR) (+26% in 2023, +25% in 2024 and +18% in 2025). Despite robust returns, CEO pay increased more moderately.

- CEO pay directionally correlated with TSR. Since 2010, CEO pay has increased at an estimated +5% compound annual growth rate, while TSR over same period has grown at +14% annually.

- Outlook: Looking ahead, we expect 2025 CEO pay to increase in mid-single digits in 2025, supported by a third consecutive year of strong TSR and financial performance.

*TDC = sum of actual base salary, bonus incentives (based on actual performance), and reported grant date fair value of LTI awards

Introduction

Median CEO actual total direct compensation (TDC) for the S&P 500 reached $17M in 2024, a 5% increase over the prior year. Total shareholder return (TSR) growth of +25% in 2024 reflects the second consecutive year of strong shareholder returns. The relatively modest CEO TDC growth in 2024, compared to increases typically seen during strong TSR periods, may be influenced by the sizable +14% increase in CEO pay in 2023. Our analysis focuses on actual TDC for S&P 500 CEOs with ≥3 years in tenure. Actual TDC reflects the sum of actual base salary, bonus incentives (based on actual performance), and reported grant date fair value of long-term incentives (LTI) awards, including any one-time LTI awards.

Historical Trends in CEO Actual TDC Pay

From 2010 through 2023, S&P 500 CEO actual TDC increased steadily, generally in line with TSR cycles. Actual TDC growth was modest in the early 2010s, accelerated during strong equity markets from 2017 to 2019, remained flat in 2020 amid COVID-related disruption, and increased more meaningfully from 2021 to 2023 as TSR and company performance rebounded.

CEO actual TDC outcomes have historically tracked S&P 500 TSR performance. Median CEO actual TDC reached approximately $16.1M in 2023, reflecting a 14% year-over-year increase supported by strong S&P 500 TSR of approximately 26%. In 2024, median CEO actual TDC grew at a more moderate pace, rising by only 5%, from $16.1M to approximately $17M (Figure 1).

TSR performance remained exceptionally strong for the second consecutive year. This sustained TSR performance reflects a robust equity market environment and reinforces the continued recovery from the volatility and negative TSR experienced in 2022. While CEO actual TDC increases were positive, this level of growth is more modest than the increases typically observed during periods of elevated TSR performance. One likely contributor to the pace of pay growth in 2024 is the substantial +14% increase in CEO actual TDC in 2023, which followed the rebound in market performance after 2022. The compensation actions taken in 2024 reflect a shift back towards more normalized year-over-year adjustments after a year of significant upward adjustment.

CEO actual TDC shows steady growth, primarily driven by LTI (Figure 2). Base salary and actual bonus incentives increased modestly each year. In contrast, LTI remained the largest driver of compensation increase, increasing 13% in 2023 and a further 3% in 2024.

Trends in CEO LTI Vehicles

Performance-based equity remains the predominant CEO LTI vehicle across the S&P 500 (Figure 3). Over time, performance- and time-based awards have increased while stock options have declined.

For 2025 and beyond, we expect the continued dominance of performance-based shares. Proxy advisors and shareholders have a preference for performance-based awards comprising ≥50% of LTI. We anticipate the use of performance-based shares has peaked, as Institutional Shareholder Services (ISS) has introduced a policy that long-term vesting restricted stock units (RSUs) can substitute for performance equity. We suspect a few companies that are having challenges setting long-term goals might move from performance equity to long-tail time-vesting RSUs.

Looking Ahead

We expect 2025 CEO pay to increase in mid-single digits in 2025, supported by a third consecutive year of strong TSR performance (+18%). This sustained TSR momentum creates a favorable environment for higher annual and LTI outcomes. However, we also expect continued negative pressure on executive pay due to scrutiny from the media, social activists, proxy advisors, and institutional investors. In addition, government regulation and executive orders will further put downwards pressure on executive pay.

Methodology

The analysis consists of S&P 500 companies led by CEOs with a tenure of ≥3 years, designed to highlight true changes in CEO compensation (as opposed to changes driven by new hires or internal promotions, which typically involve ramped-up pay over a period of 1-3 years). Actual TDC reflects the sum of earned salary, bonus incentives (based on actual performance), and reported grant date fair value of LTI awards, including any one-time LTI awards. TDC excludes all other compensation, change in pension values / non-qualified deferred compensation. This differs from target TDC (which represents the target levels for bonuses and LTI, typically set at the beginning of the year) and realizable TDC (which includes in-the-money value of stock options, ending period value of time-based awards, and estimated value of performance-based awards).