Executive and Board Compensation Reductions in Response to the COVID-19 Pandemic

Our Observations as of March 31, 2020

The societal and economic impact of COVID-19 continues to unfold, as discussed in our March 23rd Viewpoint, ” Everything Should Be On The Table .” As such, there are a myriad of compensation issues companies and compensation committees will be discussing and considering in the coming days and weeks.

Pay Governance’s research of corporate public filings, earnings transcripts and news releases from a cross-section of publicly traded companies indicates that some of the first compensation-related initiatives taken by companies are focused on executive and board member pay reductions. For reasons of cash preservation, the importance of demonstrating a shared sacrifice with employees (e.g., those that have been furloughed, had compensation reduced through budget cuts and/or reduced work schedules) and affected communities, or anticipatory action in advance of seeking federal assistance, executive salaries and director compensation are being frozen, reduced or, in limited cases, deferred.

While not an exhaustive list, we have observed the following as it relates to executive and board compensation reductions:

- Reductions in executive salaries at 105 companies were spread across a variety of industries, with the highest concentration in the retail, hospitality, airline, equity REIT and oil & gas-related industries (see Graphic 1).

- Cuts in board member compensation have already occurred at approximately 50 companies and have been generally focused on reductions or suspensions of board cash retainers.

- Actions related to annual incentives/bonuses and long-term incentives have been very limited to date, although we expect this to change over the next several months.

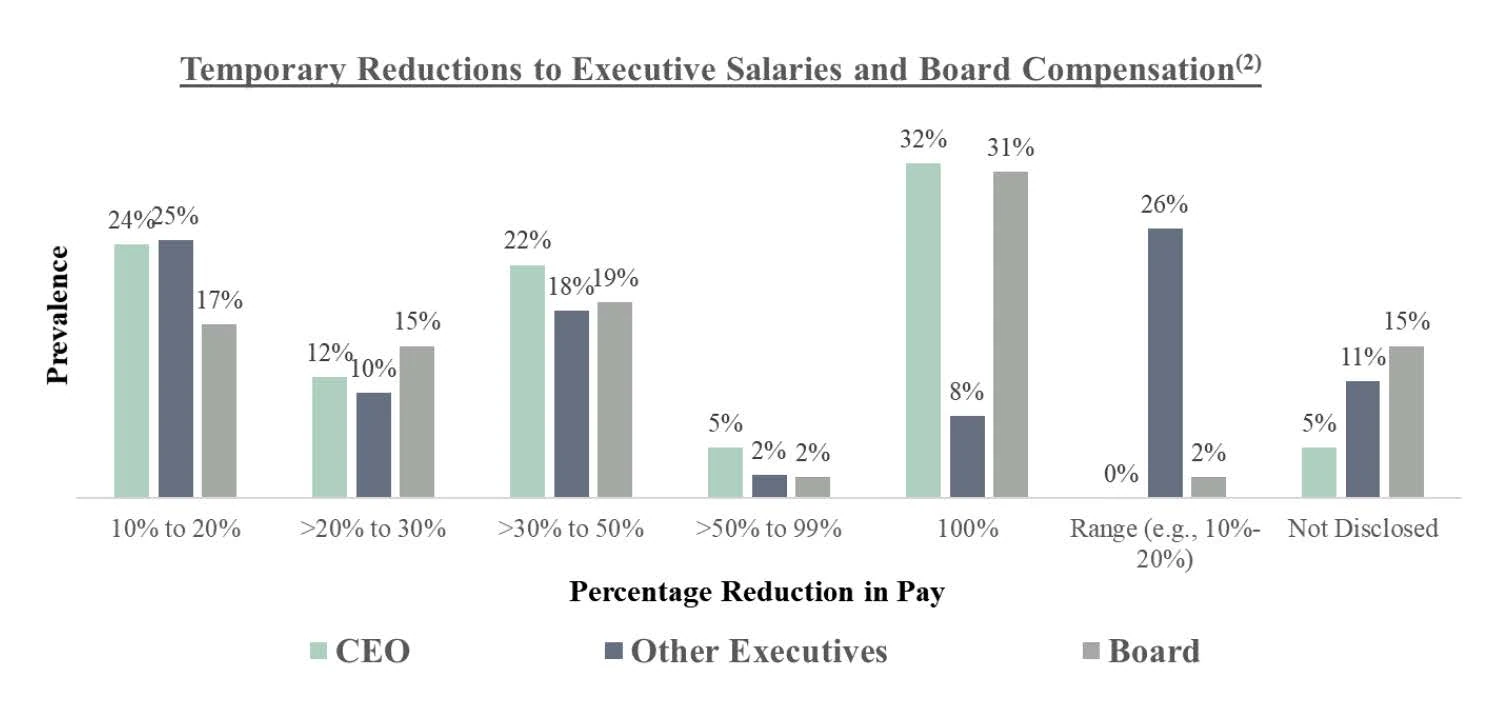

As shown in Graphic 2, the degree to which executive salaries and board cash retainers have been reduced varies, ranging from -10% to -100%. Additionally, for executives other than the CEO, one in four companies reducing pay are using a range of decreases (e.g., -10% to -20%) as opposed to a fixed percentage. This approach seems to be particularly prevalent in companies that have applied salary actions to larger numbers of executives (i.e., not just NEOs) and often reflects reductions that are tiered by executive level (e.g., -30% for EVPs, -20% for SVPs). The majority of companies reducing pay thus far have stated or implied that these executive salary and/or board compensation actions were indefinite and would be reevaluated throughout the year.

As the charts show, the vast majority of executive and board of director pay cuts have been concentrated in those industries immediately impacted by “social distancing” and travel restrictions. As the COVID-19 pandemic continues its economic ripple across the globe, other sectors may contemplate similar actions to contain costs, manage cash flows and, perhaps most notably, recognize the economic pain being felt by employees, communities and key stakeholders.

Committees contemplating similar actions should be mindful of some key considerations including the following before taking action:

- Take into account a combination of critical factors such as the cash needs of the company, the degree of broad-based employee impact at the company, industry dynamics and market practices to determine the appropriate amount of salary reductions.

- Set a formal check-in date (e.g., Q3 Board Meeting) to determine if the reduced salaries should continue or the prior salary should be reinstated.

- Evaluate whether any other elements of pay and benefits (e.g., annual incentive/bonus opportunity, long-term incentives, cash severance formula, pension contributions, etc.) may be impacted by a reduced salary and structure a policy addressing how other programs will be affected.

Graphic 1

(1) Reflects industries with prevalence greater than 1% from sample of 105 companies.

Graphic 2

(2) Specific to Board Compensation statistics, 70% disclosed reduction to cash compensation and 30% did not specify.

***************