Is It Time to Surrender Underwater Stock Options?

Introduction

The COVID-19 pandemic is an unprecedented global crisis. The economic impact of the pandemic has resulted in the Dow Jones Industrial Average (DJIA) initially losing 10,000 points, approximately one-third of its value. Some companies have experienced a decline of 75 percent or more in their share prices. Certain industry sectors, especially airlines, oil and gas, hospitality, and retail, have been hit especially hard by the pandemic-caused economic downturn. Many market analysts predict a robust market recovery, but questions persist: how soon will the recovery occur; when will stock prices return to pre-pandemic levels; will all industry sectors experience a full economic recovery?

Most companies with calendar-year fiscal years (i.e., fiscal years ending December 31) grant their long-term incentive awards in the January-February timeframe. This means that many companies granted their equity incentives prior to the pandemic when stock prices were near all-time highs. Now, these same companies may be looking at recently issued stock option grants that are deeply underwater.

Is now the opportune time for companies to think about surrendering and re-pricing (hereinafter referred to as an “exchange”) underwater stock options? In the coming months, we expect many companies that regularly grant stock options to key employees to give stock option exchanges some serious consideration. There are certain advantages to an exchange of options transaction, including the potential removal of an element of compensation that lacks motivational value that can be viewed as disincentive by employees. In addition, an exchange transaction may result in the return of shares to the company’s equity plan reserve which can result in a more efficient use of equity compensation while helping to minimize shareholder dilution and stock overhang positions. There are several disadvantages to option exchanges as well that need to be considered, especially the shareholder relations issues which will arise.

In the following sections of this Viewpoint, we will illustrate the mechanics behind a typical exchange of underwater stock options transaction. We will also discuss the views of institutional investors and the proxy advisory firms as well and provide some history of companies that have engaged in such transactions. We will also tackle some of the tough questions about this subject, such as “how far underwater should stock options be to consider the viability of a stock option exchange transaction?” We want to point out to the reader, however, that Pay Governance is not taking an affirmative position with respect to option exchanges but instead is attempting to provide a balanced view about the issues surrounding this frequently debated subject.

Voluntary Exchange of Underwater Options for New Option Grants

In Pay Governance’s experience, most stock option exchanges involve a voluntary surrender of deeply underwater options in exchange for new option grants at the current stock price (i.e., a stock option-for-stock option exchange). In this section, we outline the basic mechanics of this type of program, which involves multiple steps. Our example assumes:

- Company ABC has 1.0 million underwater stock options granted at exercise prices of $18, $20, and $22, respectively (3.0 million total options), with remaining terms of 6, 7, and 8 years. The options vest 100% after 3 years (3-year cliff).

- Company ABC’s current share price is $8.

Step 1: Calculate a current fair value of the underwater stock options

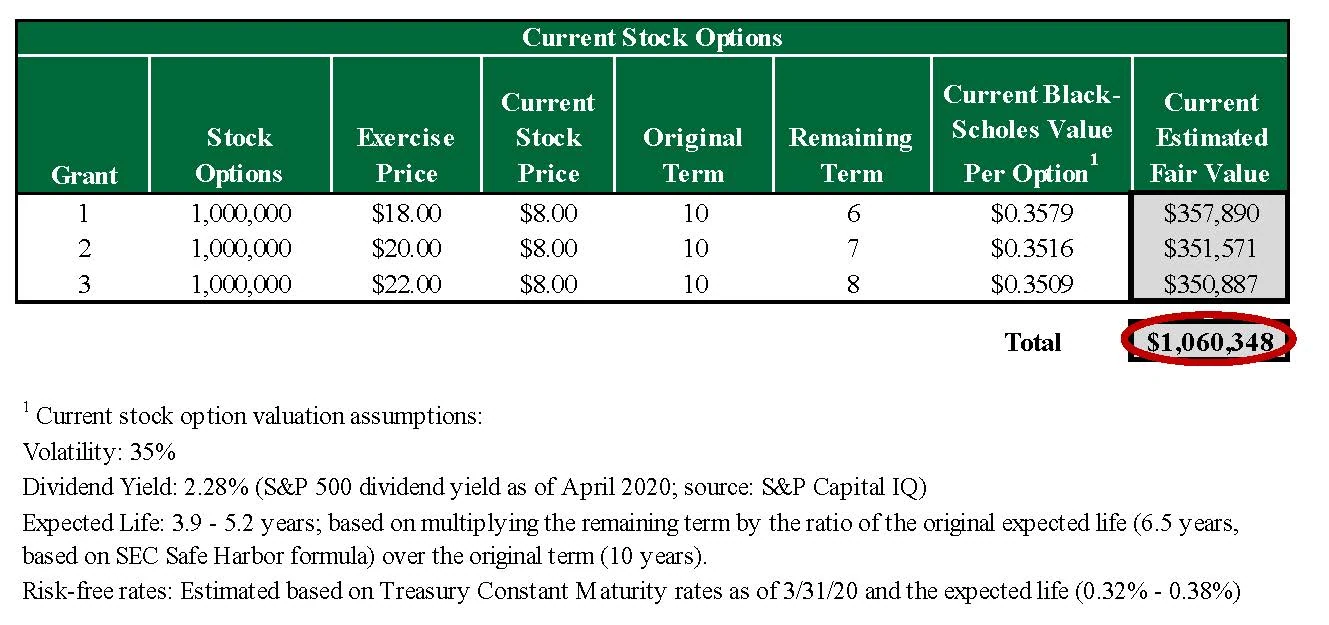

Although Company ABC’s stock options are currently underwater and the intrinsic value of these options is $0, a current fair value can still be established based on a Black-Scholes model valuation. These current fair values reflect the basis of a “value-for-value” exchange and will typically be significantly lower than the initial grant-date fair value. In total, the current fair value of Company ABC’s 3.0 million stock options is estimated to be $1,060,348:

Step 2: Calculate the number of new stock options needed to deliver an equivalent fair value

The next step in a “value-for-value” exchange includes calculating the number of new stock options needed to deliver an equivalent fair value to the 3.0 million options based on the current stock price of $8.00. For this purpose, we assume the new options will include new 3-year cliff vesting, a 6-year term, and an exercise price at the current stock price of $8.00. The total number of new options to be granted is calculated based on two scenarios:

- Full “value-for-value” exchange: New options based on 100% of the current fair value ($1,060,348).

- Discounted “value-for-value” exchange: Exchanges are often done at a discount to current fair value (e.g., 90%) so that no incremental accounting expense is taken and to assist in an exchange’s presentation to shareholders who need to approve it.

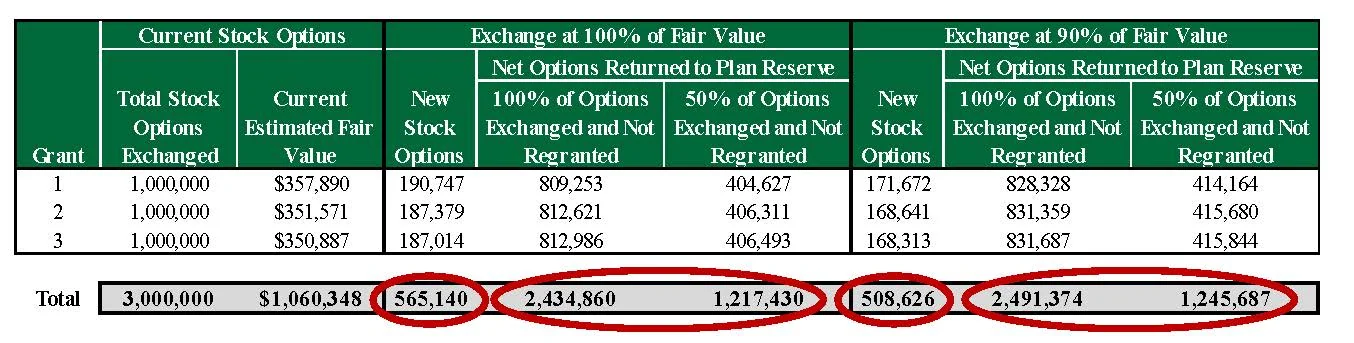

In a full “value-for-value” exchange (100% of current fair value) , 565,140 new stock options are issued in exchange for the 3,000,000 underwater options:

In a discounted “value-for-value” exchange at 90% of current fair value , 508,626 stock options are issued in exchange for the 3,000,000 original options:

Step 3: Share Reserve replenishment following exchange

Following Steps 1 and 2, the number of options exchanged and not regranted (i.e., “net shares”) may be added back to a company’s equity plan share reserve for future grant, subject to the plan’s share counting rules. For Company ABC, we outline the number of net shares added back to the plan from Step 2 based on two scenarios:

- 100% of net shares added back to Company ABC’s share reserve.

- 50% of net shares added back to Company ABC’s share reserve (the remaining net shares will be retired).

Under our scenarios outlined above, 3.0 million underwater stock options at Company ABC could be exchanged for ~510,000 to ~565,000 new stock options and ~1.22 million to ~2.5 million net shares could be added back to Company ABC’s equity plan for future grant (depending on the scenario).

Legal and Disclosure Implications to Company Regarding an Option Exchange

It is important to note that stock option exchange programs in which underwater options are surrendered in favor of reissued options are voluntary programs. As the employee makes an investment decision upon an election to participate, exchange programs are typically considered “tender offers” under the Securities Exchange Act of 1934 (the “Exchange Act”) and are subject to the conditions of Rule 13e-4 of the Exchange Act. Pursuant to Rule 13e-4, a company is required to file a Schedule Tender Offer with the SEC upon initiation of a stock option exchange program. Key requirements of the Tender Offer reflect:

- It must include the general terms of the stock option exchange.

- It must be distributed to all eligible employees.

- It must remain open for at least 20 business days.

- A company also must generally file any written communications, such as press releases and employee communications, with the SEC.

As NYSE and NASDAQ listing standards require shareholder approval for a stock option exchange program unless a company equity plan specifically permits option repricing or exchanges without this approval, a company must also typically disclose the material terms of the exchange program in a proxy statement to shareholders in advance of a vote. This approval can be sought in the proxy statement voted on at a company’s annual shareholder meeting or, if necessary, through a special shareholder meeting.

Finally, as a stock option exchange reflects a material modification of an outstanding equity award, a company should consult its auditor and outside legal counsel on the accounting expense or tax implications of a proposed exchange prior to finalizing a Tender Offer and filing a proxy statement for shareholder approval.

Alternatives to a Stock Option-for-Stock Option Exchange

While our experience is that a clear majority of stock option exchanges reflect the stock option-for-stock option exchange outlined above, there are alternative exchange mechanisms a company could consider:

- Stock Option-for-Other Equity Incentives: In this example, underwater stock options are exchanged for a new equity vehicle, such as performance shares or restricted stock. The fair values of the new equity vehicles delivered in the exchange would typically be based on the current Black-Scholes fair value of the underwater options, similar to the option-for-option exchange.

- Stock Option-for-Cash Purchase: A company offers employees a cash buyout of the underwater options based on the current fair value of the underwater options.

- Amended New Option Award: A company unilaterally amends the terms of the underwater stock options by adjusting the exercise price of the options, and the option holder has no exchange rights.

The Views of the Proxy Advisory Firms

Proxy advisors (ISS/Glass Lewis) evaluate option exchange program proposals on a case-by-case basis and can be convinced to support an exchange based on how the exchange program is designed and intended to be implemented. In our experience, successful proposals typically follow ISS/Glass Lewis guidelines, including:

- Rationale is well-explained, including that stock price decline is beyond management control.

- Executive officers, directors, and retirees do not participate.

- Exchange is less than value-for-value (e.g., “85%-90%” of Black-Scholes value or granted at a premium to 52-week high).

- Minimum vesting provisions added, even for vested options.

- The exchanged options’ term should remain the same as that of the replaced option.

- Shares exchanged and not issued should be retired or considered part of a new reserve request that reflects the total cost of the equity plan and burn rate.

Despite “Against” recommendations in most instance, recent voting results for stock option exchange proposals suggest that most have received shareholder support.

Based on ISS’ policy guidance related to COVID-19, ISS will continue the current approach of applying existing case-by-case policy approach for the relevant market during the circumstances of the COVID-19 pandemic. However, ISS will generally recommend opposing any exchange that occurs within one year of a precipitous drop in the company’s stock price.

Pay Governance reviewed 38 stock option exchange proposals since 1/1/2015 for US companies. Of these companies, 37 of these proposals have passed with an average support of 78.5% with the majority receiving an “Against” recommendation from ISS. These proposals and vote results have garnered varying levels of support among institutional investors with some stating that they will vote against regardless while others will consider the merits of the proposal.

The Views of Institutional Investors to Option Exchanges

For most institutional investors, option exchanges are evaluated on a case-by-case basis similar to proxy advisors. While no ‚Äòcookie-cutter’ proposal exists, many of these proposals have many features in common such as:

- Shareholder approval is sought;

- Rational is well explained;

- Executive/senior officers, board of directors, and retirees are prohibited to participate;

- Exchange is value neutral or at a discounted value (e.g. 85-90% of Black Scholes value);

- Minimum vesting requirements are added, even for vested options;

- Exchanged options’ term should remain the same as that of the replaced option; and

- No material increases in cost attributable to recycled shares.

These provisions are similar to those that are required in order to receive favorable recommendations from proxy advisors.

Some Difficult Questions

Though there may be no definitive answers that apply in all situations, we have attempted to provide thought leadership on a few additional pertinent questions, as outlined below.

How far underwater/into an option term should a cancellation/re-pricing be considered?

We evaluated the stock-price performance of S&P 500 constituents from 2010-2020. By modeling a seven-year option term, this analysis reflects a robust sample of four post-financial-crisis grant cycles (2010-2013).

As shown in the table above, there is a meaningful relationship between the percentage stock price decline, remaining option term, and the likelihood of options finishing the term “in the money.” The threshold for considering an exchange depends on the likelihood of finishing in the money without intervention. For example, if a company’s internal threshold reflects a 33% chance of organic recovery, the following levels would warrant consideration for an exchange:

- >60% underwater after one year;

- >40% underwater after two years;

- >30% underwater after three years;

- ~20% underwater after four years;

- ~20% underwater after five years; and

- ~15% underwater after six years.

However, companies might reasonably be hesitant to exchange recent grants or those that are not significantly underwater. Using the same 33% recovery assumption would result in the following range for potential exchange proposals:

- 40% – 70% underwater after two years; and

- 30% – 50% underwater after three years.

Can the proposed exchange receive a favorable vote even if ISS delivers a negative advisory vote?

Despite ISS “Against” recommendations in most instances, recent voting results for stock option exchange proposals suggest that most have received shareholder support. Over the past five years, nearly all stock option exchanges studied (mostly small tech companies) have passed, with average support of 78.5% support, despite ISS recommending “Against” in nearly all these proposals.

What proactive steps should management and the Board take if the company elects to proceed with an option cancellation/re-pricing?

In addition to the steps above relating to proxy advisor preferences, companies should consider the following actions to proactively earn support from the stockholder community:

- Work closely with the Board to ensure internal alignment and support;

- Conduct significant investor and proxy advisor outreach;

- Seek formal stockholder approval.

Pay Governance Commentary

In our role as management consultants, Pay Governance does not advocate option exchange programs to its clients. We tend to take an unfavorable view of exchange proposals when top executives participate or when a value discount is not taken to recognize that employees are receiving direct beneficial treatment that has not been afforded to all other shareholders. However, on a case by case basis, there may be compelling reasons to analyze and consider an option exchange program when circumstances outside of management’s influence possibly warrant an exchange of deeply underwater options. This is an issue that must be carefully analyzed and vetted with institutional investors and shareholders before serious consideration of an exchange is contemplated.

***************