Demonstrating Pay and Performance Alignment: A Comparison of Compensation Actually Paid and Realizable Pay

KEY TAKEAWAYS

Shareholders and companies may find the results of our comparison of Compensation Actually Paid (CAP), as presented in the new Pay Versus Performance (PVP) tables in 2023 proxy statements and Realizable Pay (RP) of interest for the following reasons:

- There is no perfect solution for evaluating pay for performance.

- Summary Compensation Table (SCT) compensation values are not useful when measuring pay for performance but serve a valuable corporate governance purpose, primarily by showing Board/Compensation Committee intent when providing various compensation programs.

- The new CAP disclosure provides a better understanding of pay for performance than SCT compensation, but the results can be distorted by the inclusion of certain mandated items such as equity awards granted prior to the performance measurement period.

- RP generally provides a more rigorous approach to matching the time period for compensation with the performance underlying such awards.

We believe RP can provide Compensation Committees with more robust insights when evaluating pay for performance than tools based on the SCT or PVP methodologies and should be a consideration in addressing this important corporate governance issue.

The new PVP disclosure requirement from the Dodd-Frank Act of 2010 evolved from the belief of a limited relationship between executive pay and shareholder performance which, in turn, had become a significant corporate governance issue. This belief was documented by the SEC in the PVP final rule, which cited the legislative history of the new disclosure requirement:

“…the relationship between executive pay and performance has become a ‘significant concern of shareholders,’ and that the required disclosure should ‘add to corporate responsibility,’ as registrants will be required to provide clearer executive pay disclosures.”1

Companies have long searched for a methodology to evaluate the relationship between pay and performance, even prior to the enactment of Dodd-Frank, with limited consensus. This void was quickly filled by the proxy advisory firms, which developed their own quantitative pay for performance models that rely on SCT compensation values. These quantitative models generally serve to predict the proxy advisory firms’ Say on Pay voting recommendations, even though much of the compensation reported in the SCT is pay opportunity, rather than pay outcomes. The new PVP disclosure requirement is also a tacit admission by Congress that the SCT compensation values may not be suitable for assessing the alignment of pay and performance.

We demonstrated the limitations of using SCT compensation to evaluate pay for performance compared to CAP, the SEC’s new definition of compensation for PVP disclosure, in a recent Viewpoint. As highlighted below, total shareholder return (TSR) is highly correlated with changes in CAP and in contrast, changes in SCT compensation reflect a low correlation with TSR.

We believe CAP may be better for measuring pay for performance than SCT compensation. However, CAP includes several significant distortions when measuring the alignment of pay and performance primarily due to:

- the inclusion of equity awards granted outside the performance measurement period;

- the use of stock option expected values that often far exceed the in-the-money/intrinsic value of such awards.

In our opinion, pay for performance models that preceded CAP, such as Realizable Pay (RP), are more useful for evaluating pay and performance than the new PVP disclosure. About 10% of the S&P 500 disclosed the use of RP to evaluate pay outcomes compared to company performance in their most recent proxies. While existing RP models may vary, each has the goal of evaluating the relationship of a company’s pay programs and shareholder/financial performance for a given performance period. Since its founding 13 years ago, Pay Governance has used an RP methodology to evaluate pay for performance.

The SEC’s final rule also noted a recent survey of investors by one of the proxy advisory firms indicated that 84% of investors supported using an outcomes-based measure such as RP in a quantitative pay for performance analysis.2

The SEC believes the new PVP disclosure “is similar to the concept of RP”. 1 This Viewpoint compares how CAP and Pay Governance’s RP differ by the various elements of compensation and describes the implications of such differences in evaluating pay for performance.

Comparing CAP and RP by Element

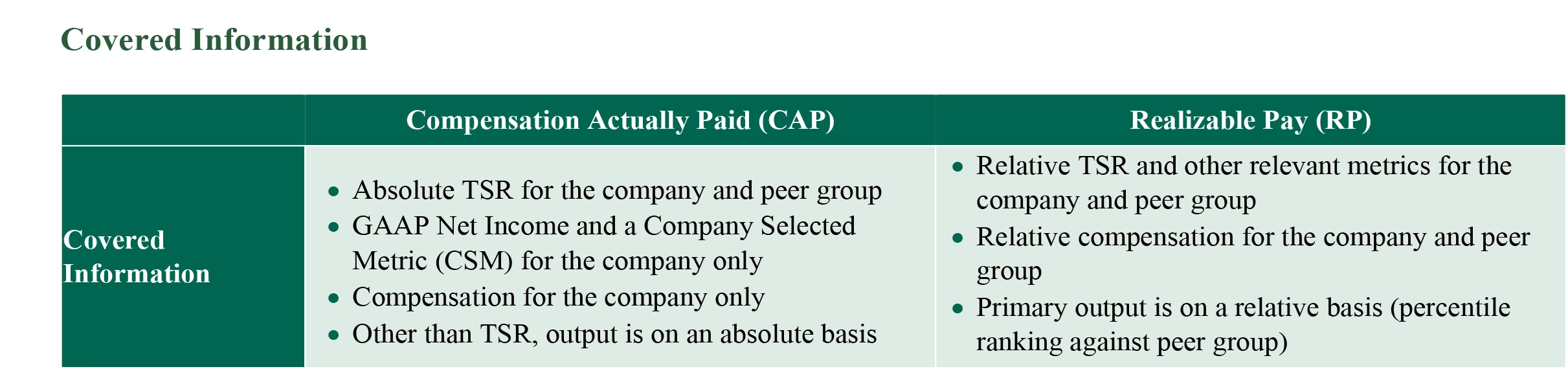

CAP and performance in the new PVP disclosure are shown annually, which allows for year-over-year comparisons of pay and performance but may cause an undue focus on a short-term evaluation of pay and performance. RP, which aggregates compensation and total performance over a 3- to 5-year period, has a longer-term focus to match those of executives and shareholders.

The final PVP rules require disclosure of several metrics, allowing for performance to be evaluated from many angles. However, the rules fall short in one major way ” they do not provide comparisons of both pay and performance on a relative basis (i.e., compared to a peer group of companies that compete for talent, resources, and business). This relative comparison is what provides investors with context for the quantum of pay and is critical to reaching meaningful conclusions about the pay for performance relationship. The importance of relative comparisons is evidenced by the proxy advisory firms and some investors that use relative SCT compensation and shareholder performance in their pay for performance models.

RP measures both pay and TSR performance on a relative basis (i.e., using percentile ranking). This normalizes the results and allows for more useful comparisons to peers. In addition, RP analyses may include other important metrics relevant to a company, allowing relative performance evaluations to be conducted across several performance metrics in addition to TSR.

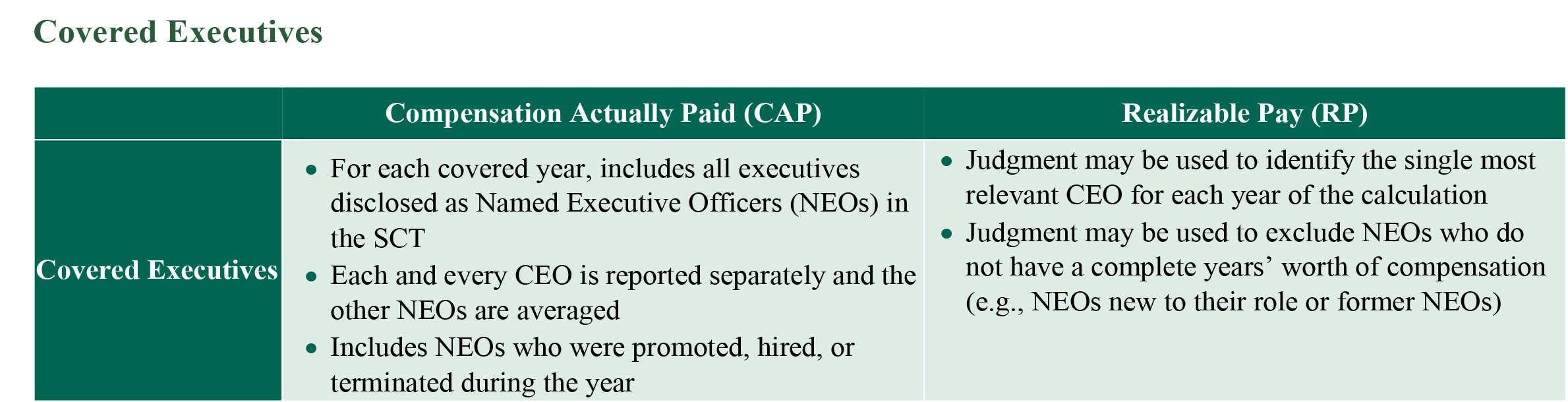

CEO and other NEO transitions often distort compensation and may lead to misleading results due to the inclusion in CAP of items such as:

- Forfeiture or acceleration of equity

- Severance payments in termination scenarios

- Partial year compensation for new hires or terminated executives

- Promotional, new hire, make-whole, and other special awards

As described in more detail below, Pay Governance investigates each company’s situation to create the truest picture of ongoing CEO and other NEO compensation.

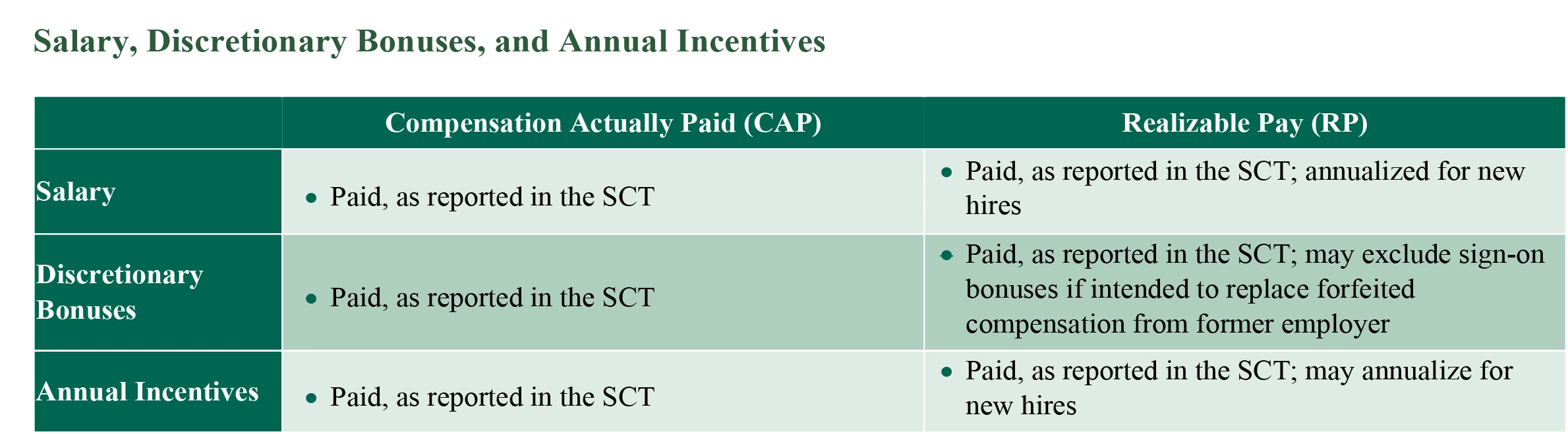

Salary, bonuses, and annual incentives are the least contentious components of compensation in terms of how they should be measured. However, CAP does not annualize or make any adjustments for newly hired executives, which can result in distortions of annual cash compensation.

With RP, Pay Governance investigates each incumbent to present the truest picture of annual cash compensation. This often involves reading CD&As and 8-Ks to find salary rates or annualizing amounts based on hire dates.

We believe CAP overstates compensation by including the change in value of grants made in years prior to the PVP performance measurement period. These prior year awards often include tranches of equity awarded 3 and 4 years prior to the commencement of the PVP measurement period. Indeed, based on Pay Governance’s analysis of 160 S&P 500 companies, the change in CAP was significantly affected by the change in value of the prior year awards (74% of the change in CAP from 2021 to 2022 and 58% of the change in CAP from 2020 to 2021).3 The significant proportion attributable to prior year awards is due to the cumulative effect of the number of unvested shares remaining from grants made during these prior periods.

Another difference occurs as CAP stops tracking changes in the value of equity awards once they vest. This SEC requirement essentially assumes the executive sells all the shares immediately upon vesting, which is often not the case. The SEC notes that once vesting occurs, the executive’s decision to retain or sell the shares is an investment decision, and any change in stock price thereafter is unrelated to compensation. In high volatility markets, this valuation approach could differ significantly from other methods, such as valuing at the end of the performance period as does RP.

In contrast, RP assumes that all the shares granted and vested during the 3- or 5-year measurement period are retained until the end of the period to measure the impact of the change in stock price on awards granted during the measurement period. While this assumption ignores that some shares may have been sold or withheld to cover taxes and exercise price, the impact is normalized on a relative basis as RP makes the same assumption for all companies in the peer group.

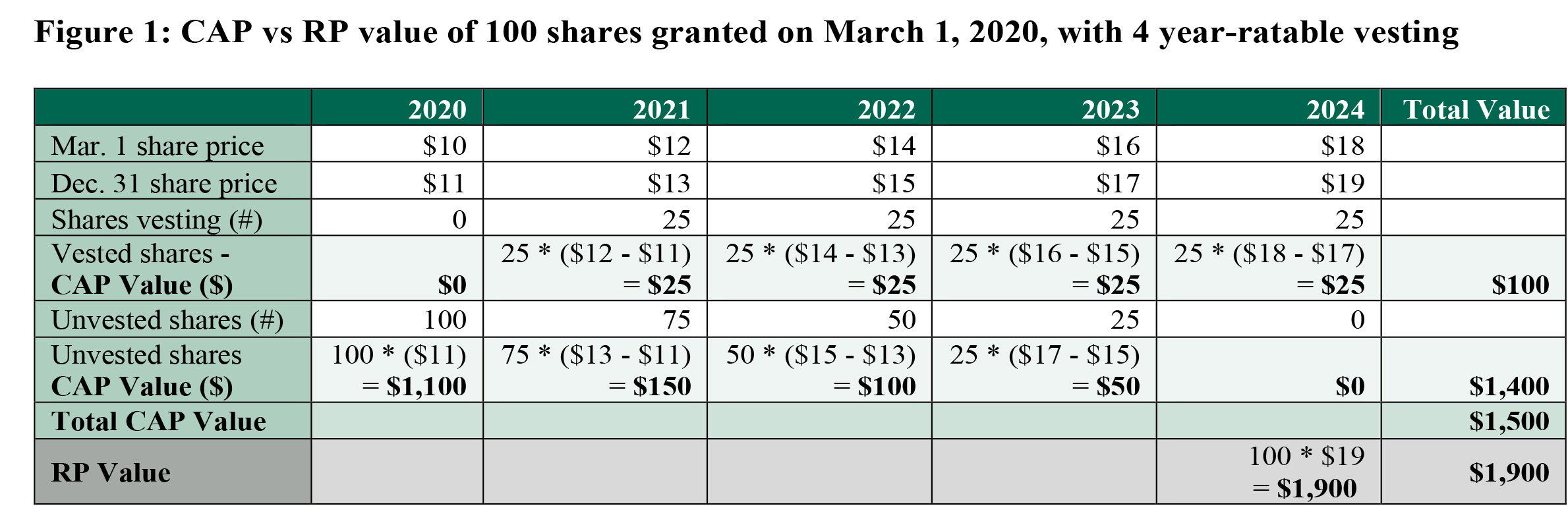

Figure 1 below provides an example where CAP understates appreciation compared to RP when stock grows over a 5-year period.

As noted above, CAP values each tranche as the shares vest, resulting in a cumulative CAP amount for this award of $1,500, whereas RP assumes all 100 shares are held at the end of year 5 at $19 per share, or $1,900.

The same points discussed above for time-based RSAs/RSUs regarding an overstatement of compensation due to including equity grants made outside the measurement period and disconnect of valuing awards at vest are also true for time-based stock options and SARs.

In addition, there is typically a large variance observed between CAP and RP due to CAP’s use of expected valuation models, (e.g., Black-Scholes) versus RP’s use of intrinsic value. This variance is most pronounced for underwater stock options and SARs, where RP would include a value of $0, and a Black-Scholes valuation used to determine CAP will often include a material value to estimate the award’s potential future value (unless awards are significantly underwater).

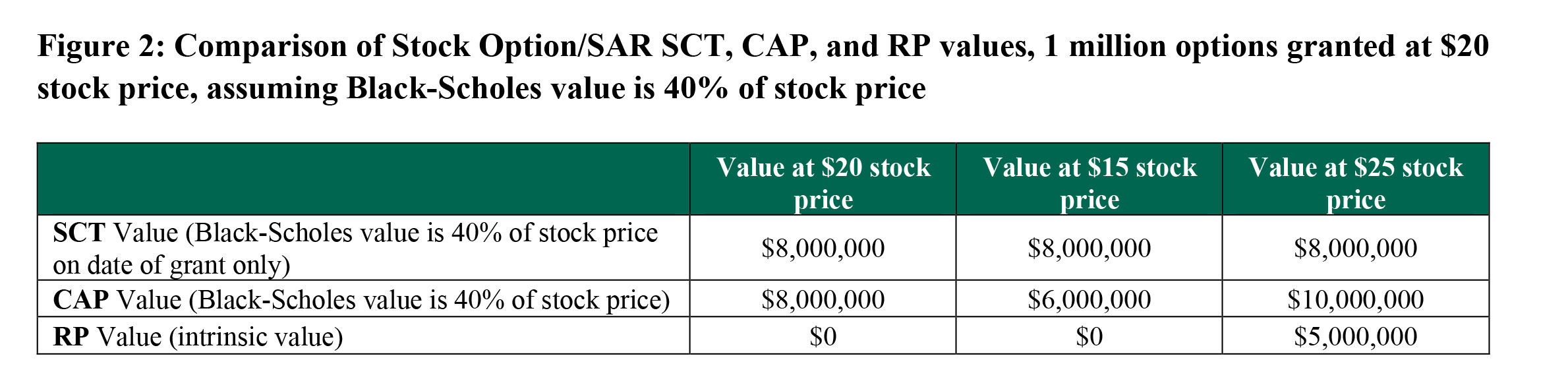

Figure 2 below illustrates the difference in stock option values based on SCT, CAP and RP.

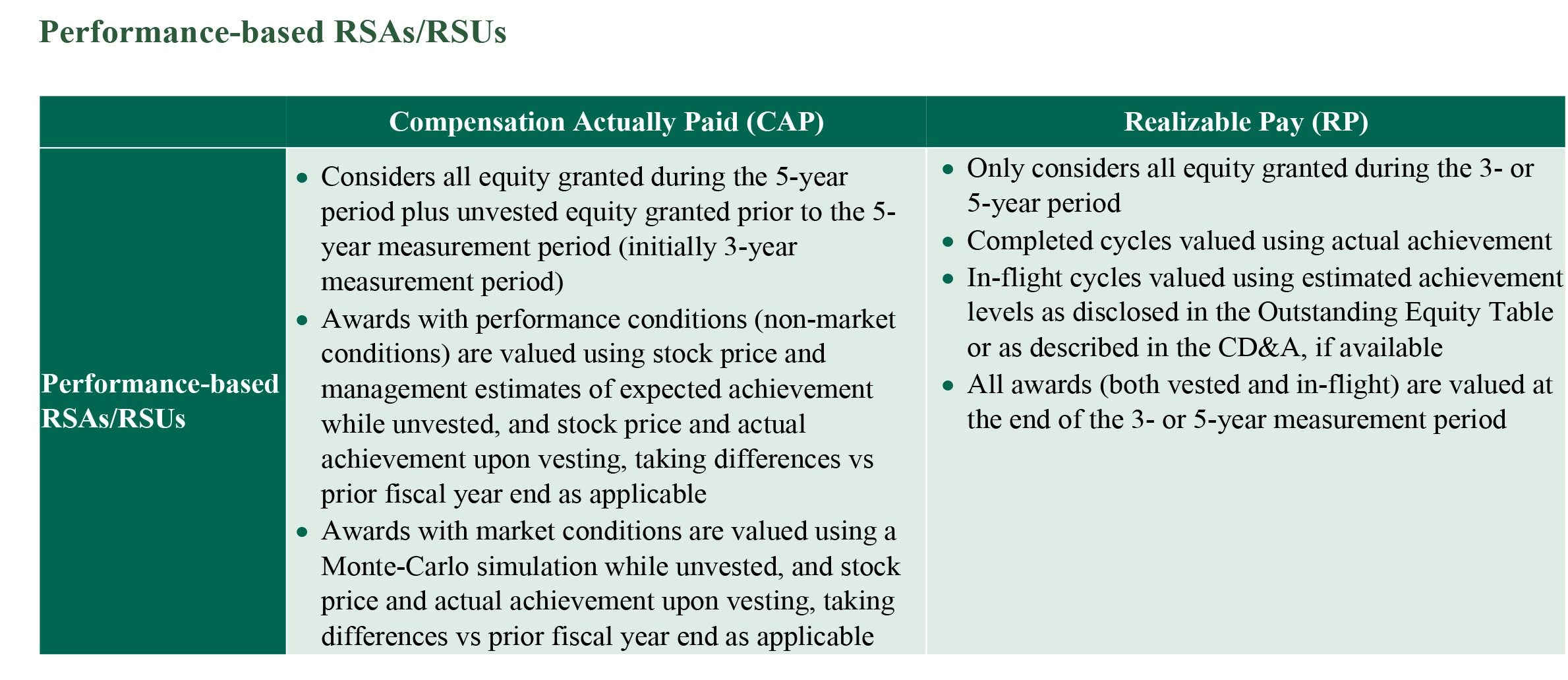

CAP’s requirement that in-flight performance cycles be valued based on expected performance is one of the largest differentiators to RP. Expected performance estimates are often based on confidential information and are rarely disclosed in the PVP table footnotes or the broader CD&A. CAP values for in-flight performance share units (PSUs) that are based on a market condition (i.e., stock price hurdles, relative TSR, or absolute TSR) are based on a Monte Carlo simulation of future performance. RP is based on the footnotes to the Outstanding Equity Table, which discloses actual performance for the most recently completed performance cycle and either threshold, target, or maximum payout levels for the remaining in-flight PSU awards. In cases where companies electively disclose estimated payout levels for in-flight awards within the CD&A, RP will reflect those values.

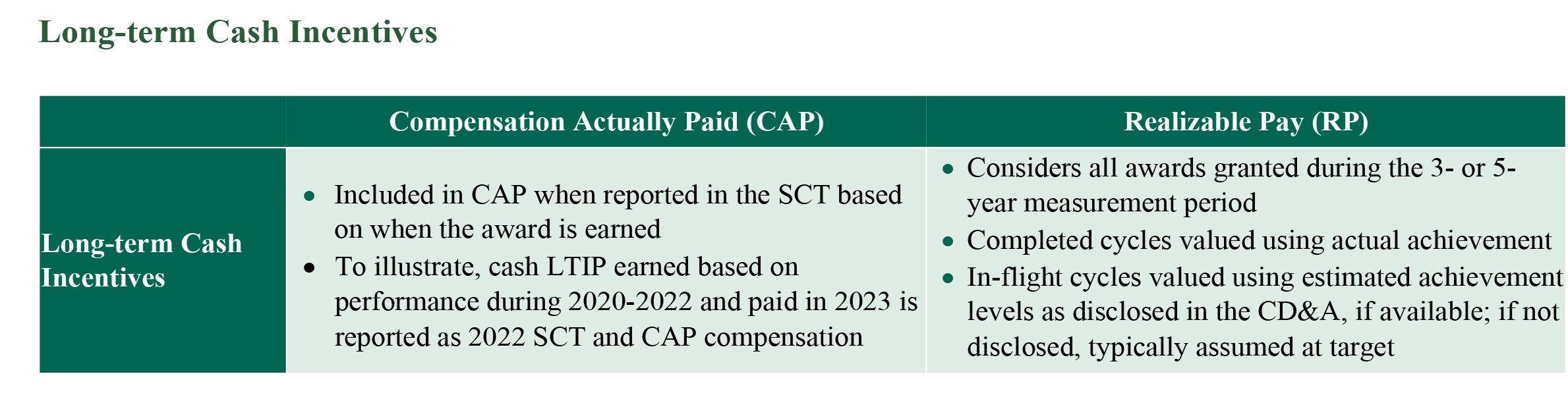

CAP ignores the value of in-flight performance cycles for cash-based long-term incentives, which is at odds with the mark-to-market valuation requirement for PSUs. Thus, CAP ignores what could be a material portion of an executive’s long-term incentive in determining PVP. RP, on the other hand, considers the awards made during the performance period, including payouts of relevant completed cycles and estimated levels of achievement for in-flight awards.

Most companies have either frozen or terminated existing defined benefit plans or never adopted such plans, and very few companies provide preferential earnings on NQDC plans. Moreover, where such arrangements do exist, the impact is generally modest to immaterial. Removing the value attributable to various changes in assumptions of pension plans and only accounting for service cost and prior service cost resulting from plan amendments helps reduce such numbers but could still be present as outliers in an analysis of PVP.

RP excludes all values associated with pension and NQDC plans, as such amounts are generally modest to immaterial. As a practical matter, very few companies would have been willing to incur the expense of calculating the service cost for each executive for each year for inclusion in RP absent the SEC mandate. Now that this data is available where applicable, it could be included in RP should it be relevant and material to a company’s analysis of pay and performance.

CAP includes All Other Compensation as disclosed. In many cases, the values are nominal. However, the inclusion of severance for a terminated CEO or NEO can materially distort the pay for performance relationship. RP excludes all values associated with All Other Compensation, due to immateriality and/or to better reflect ongoing compensation.

Conclusion, Implications and Considerations

Admittedly, there is no perfect methodology for evaluating pay for performance. Even if such methodology existed, it is highly unlikely a consensus on its validity would ever be reached, primarily due to potential subjectivity and value judgments required in unique situations, including in the context of judgments on peer companies for RP analyses. The SEC’s CAP values appear to be a better method for evaluating pay for performance than SCT compensation amounts. Nonetheless, the SCT combined with the CD&A continue to be used to evaluate the corporate governance of executive compensation.

It remains to be seen whether the new PVP disclosure will be found useful by investors or if proxy advisory firms will incorporate any of the CAP data in their pay for performance models.

While only 10% of S&P 500 companies expressly disclosed the use of some type of RP model to evaluate compensation outcomes with company performance, it is likely many more are using RP as part of their annual Compensation Committee process but do not disclose its use in public filings. And still others may decide to explore such RP analyses to eliminate many of the distortions included in the SCT and PVP/CAP disclosures when evaluating the alignment of pay and performance.

_______________________________________